fidelity tax-free bond fund by state

Exempt interest dividend income earned by your fund during 2021. Ad Research a Variety of Municipal Bond Funds Available from Fidelity.

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Bond Funds Fund Management

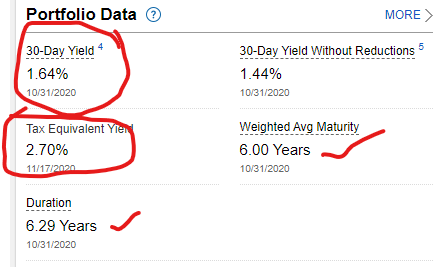

As of April 22 2022 the fund has assets totaling almost 383 billion invested in 1305 different holdings.

. Fidelity M unicipal Bond Index Fund FMBIX Fidelity M Income Fu FHIGX Fidelit y Municipal Income 2019 Fund FMCFX Alabama 365 075. Ad Discover a wide variety of municipal market investing opportunities. State Fidelity Investments Money Market Tax Exempt Portfolio.

XNAS quote with Morningstars data and independent analysis. Stay up to date with the current NAV star rating asset. All Classes Fidelity Limited Term Municipal Income Fund FSTFX Fidelity Municipal Bond Index Fund FMBIX Fidelity.

The income from these bonds is generally free from federal taxes. Fidelity Tax-Free Bond Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve. Fidelity also offers tax-free municipal bond funds that focus on states such as California New York and.

The expense ratio is 025. Normally not investing in municipal. Fidelity Tax-Free Bond has found its stride.

All Classes Fidelity Limited Term Municipal Income. However the fund may charge a short-term trading or. See Fidelity SAI Tax-Free Bond Fund FSAJX mutual fund ratings from all the top fund analysts in one place.

Find the latest Fidelity Tax-Free Bond FTABX. Fidelity provides tax information about our mutual funds for your reference including state tax-exempt income data as well as information on international funds and corporate actions. Ad Research a Variety of Municipal Bond Funds Available from Fidelity.

Gain access and insights to the muni market with Invesco funds. To lower risk these portfolios spread their assets across many states and sectors. The income from these bonds is generally free from federal taxes.

QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified national. Its portfolio consists of municipal. Ad Learn About The Tax-Exempt Bond Fund of America.

State Fidelity Investments Money Market Tax Exempt Portfolio. See Fidelity SAI Tax-Free Bond Fund performance holdings fees risk and other. Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax.

The amount of municipal bond interest from your state Puerto Rico the Virgin Islands and Guam can be calculated by multiplying the total interest dividend you received from a fund reported. To lower risk these portfolios spread their assets across many states and sectors. Your Guide to Munis Is Here.

Gain access and insights to the muni market with Invesco funds. No Transaction Fee Fidelity funds are available without paying a trading fee to Fidelity or a sales load to the fund. Ad Discover a wide variety of municipal market investing opportunities.

Your Guide to Munis Is Here. Ad Learn About The Tax-Exempt Bond Fund of America. The minimum initial investment is 25000.

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

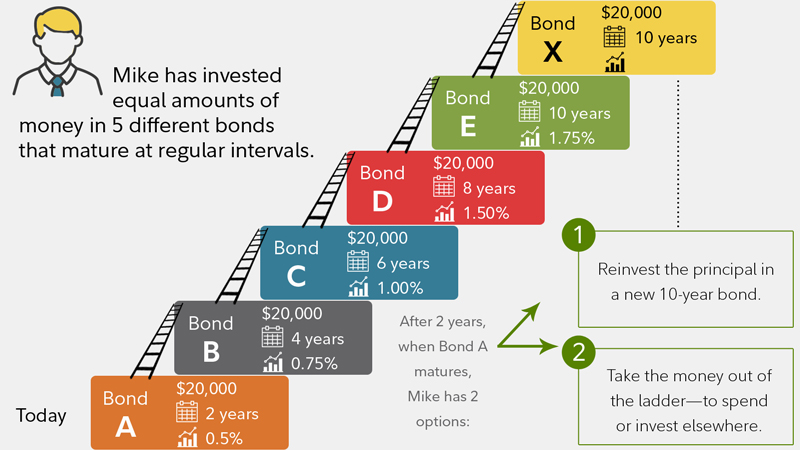

How To Build A Bond Ladder Fidelity

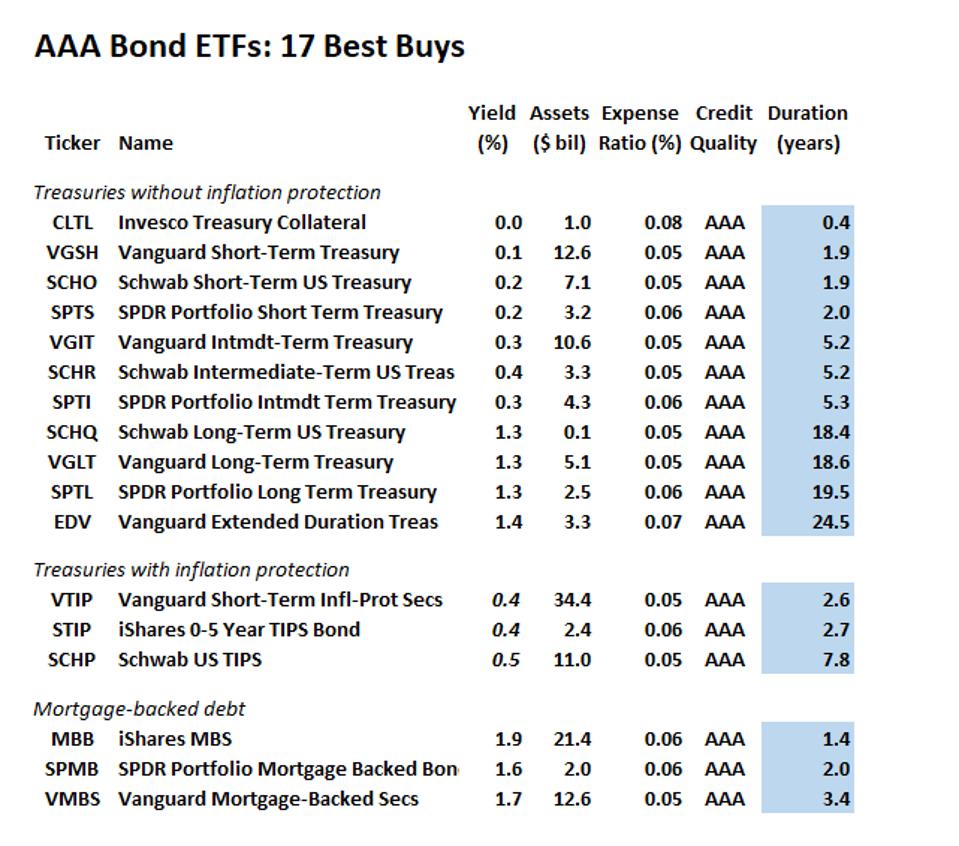

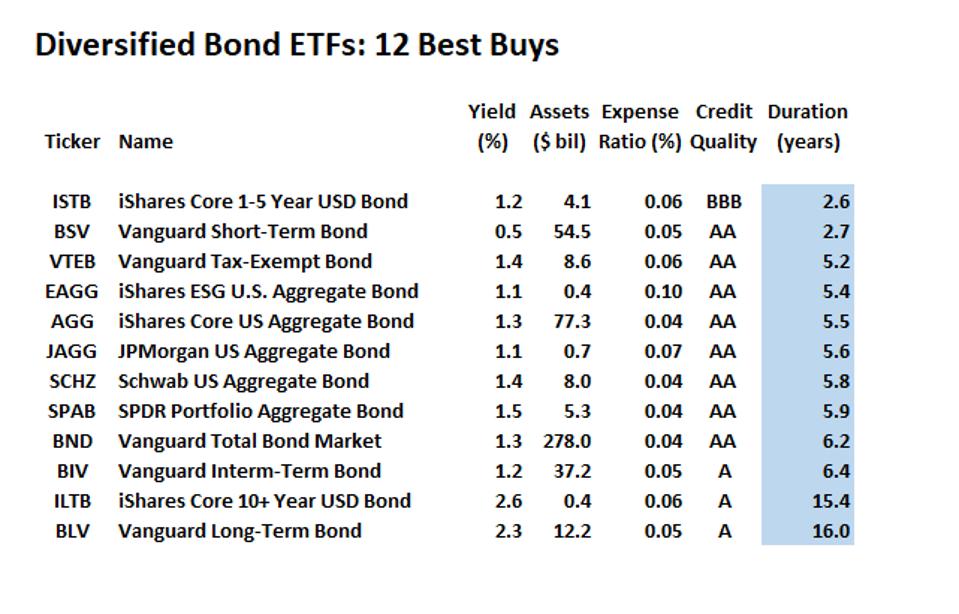

Guide To Investment Grade Bond Funds Best Buys

Which Bond Funds Are Most Exposed To Evergrande Morningstar

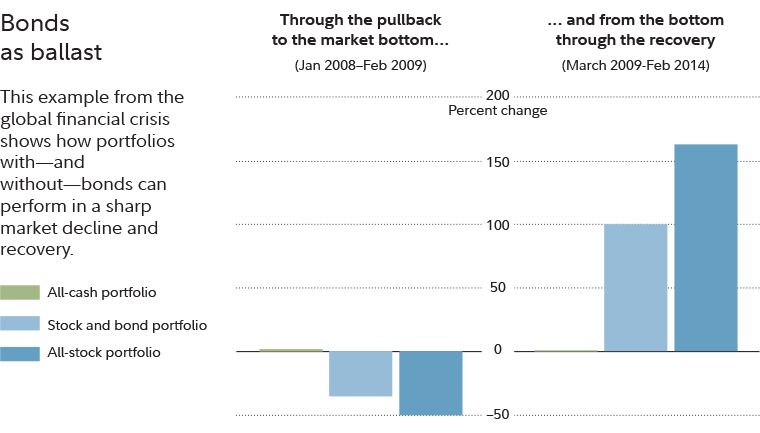

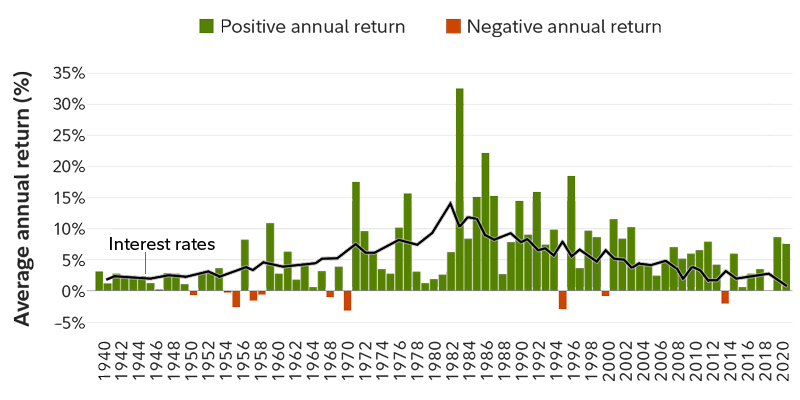

Market Watch 2021 The Bond Market Fidelity

Investing Bond Market Outlook Fidelity

Bond Fund Types Of Bond Fund Advantages And Disadvantages

Fcbfx Fidelity Corporate Bond Fund Fidelity Investments

Bond Fund Ave Maria Mutual Funds

Which Bond Funds Are Most Exposed To Evergrande Morningstar

Pin On How I Will Achieve Total World Domination

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

Market Watch 2021 The Bond Market Fidelity

:max_bytes(150000):strip_icc()/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

Everything You Need To Know About Junk Bonds

Best U S Taxable Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

Guide To Investment Grade Bond Funds Best Buys

How To Choose A Municipal Bond For Income Learnbonds Com